These 6 Coronavirus Vaccine Candidates Are The Likeliest To Succeed, Says Morgan Stanley

With about eight coronavirus vaccine candidates in clinical trials and 110 more in clinical testing, the race to a commercial product is intensifying. Against this backdrop, an analyst at Morgan Stanley looked at the most promising programs.

Millions of doses of the vaccine could be available by fall 2020, and over 1 billion in 2021, analyst Matthew Harrison said in a note. The analyst sees safety as the biggest hurdle for these expedited programs.

It should be noted that earlier Monday, Moderna Inc MRNA reported positive interim Phase 1 data for its coronavirus vaccine candidate mRNA-1273.

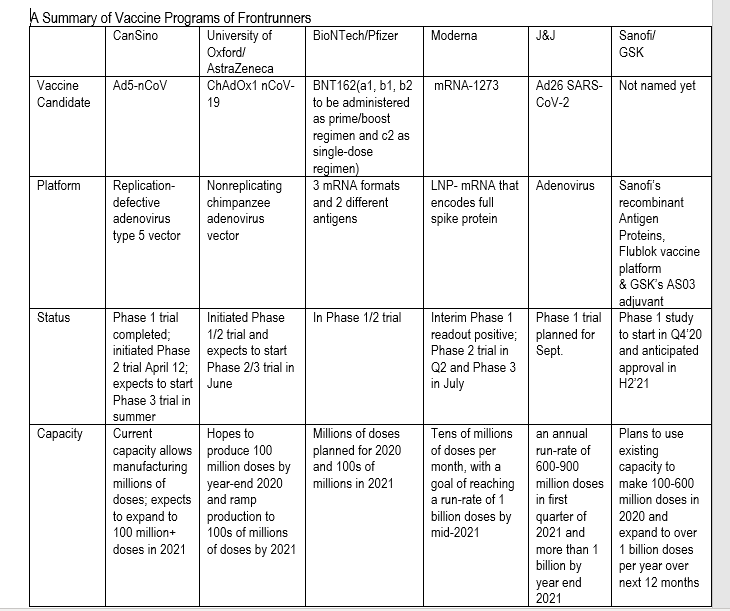

The Coronavirus Vaccine Frontrunners

Six candidates — four clinical pipeline candidates and two preclinical candidates — have a reasonable likelihood of success and can be manufactured at a notable scale, Harrison said.

COVID-19: What To Watch In Vaccines

We highlight six vaccines with the highest probability of success and the ability to manufacture at scale. We believe millions of doses could be available by fall 2020, assuming no delays and >1B doses in 2021. We see safety as the biggest hurdle for these expedited programs.

Six vaccine candidates to watch: Of the 110 vaccine candidates under development, 8 are in clinical studies. We believe 6 (4 of the current clinical candidates and 2 preclinical) have both a reasonable likelihood of clinical success and can be manufactured at scale to be relevant. We see three waves of

potential vaccines available commercially, with those from Moderna, Pfizer/BioNTech, AstraZeneca/University of Oxford and CanSino likely in the first wave before the end of 2020. We expect vaccines from J&J in 1H21 and Sanofi/GSK in 2H21.

We expect significant production available by mid-2021 with limited quantities as early as fall 2020: In the near-term we expect to learn if the earliest-to-clinic vaccines produce antibodies against the virus in humans. CanSino has a 508 patient PhII study which is expected to have data in May (how and when it is released remains unclear), while we expect the US NIAID to provide data from

Moderna's PhI study in the next 1-2 months. These data will provide initial information about potential efficacy, but will not provide enough information about safety. We would expect to have a clearer picture from Moderna, AstraZeneca and potentially Pfizer on safety by fall 2020. While these

companies may be granted emergency use authorizations (EUAs) in the fall of 2020, we would not expect a BLA filing until YE20. Based on current company commentary, we believe millions of doses of the vaccine could be available in the fall, 10-30M/month by YE20 and 100s of millions per month by mid-2021.

Initial clinical efficacy may be complicated to judge, but we provide a rough guide: We will be watching the proportion of patients that achieve neutralizingn tibody levels (titers). Because such titers are not established, we will compareagainst animal models as well as antibody titers achieved in cohorts of patients who have recovered from COVID-19. We believe the NIAID is currently working to establish neutralizing titer thresholds that could potentially confer protection

and such data could be available prior to the release of initial vaccine data.

How do the current manufacturing projections compare with project warp speed? The Trump administration has indicated that it plans to have enough doses of vaccine for the entire US population by the end of 2020. Based on current projections from the leading candidates that could be available to the US population, those manufacturers are unlikely to reach a few hundred million

doses in aggregate until 1H21. Thus, while it may be possible to accelerate that effort, we believe resources will need to be devoted immediately to potentially achieve such a goal.

We believe the pandemic market could be $10-30B, while the endemic opportunity could be ~$2-25B: Of the world's population, we assume ~1.8B people are in markets that would be served by western companies, in particular the US (~330M), Western Europe (~400M), some of Eastern Europe (~115M), South America, Canada and Mexico (~590M), and some Asia-Pacific countries

(~210M). We assume India (~1.3B), China (~1.4B) and Russia (~150M) will likely not buy a western vaccine while Africa (~1.2B) and the remaining population (~1.9B) would be largely a donation market. We see US pricing at $10-20/treatment, Western Europe at ~$5-15 and the remaining countries at ~$5-10.

This leads to our $10-30B market range for the 2020-2022 pandemic season.

Importantly, while companies such as J&J have committed to selling their vaccine at cost (at least for the pandemic period), we believe cost may include recovery of R&D expenses, capex and manufacturing fees. Further, we do not believe cost is likely to be below $5-10/dose. Assuming that there may be mutations in the spike protein with selection pressure, unvaccinated populations which keep the virus endemic, a limited duration of protective antibodies and the need to vaccinate newly born children, we see a potential annual endemic market of ~$2-25B based on 10-60% annual vaccination rates and modestly higher pricing. In the endemic phase we see the key markets as the US, Western Europe,Canada/Mexico and some Asia-Pacific countries.

Learn Step-by-Step How to Trade Stocks & Options

Last month, we premiered our very first Benzinga Boot Camp to over 10,000 traders! Our Boot Camp series returns in a new & improved format on Friday, May 29!

Don’t miss out on this opportunity to expand your skills in trading so you can start profiting from your trades.

Click here to register before this masterclass fills up!

The analyst projects three waves of commercially available vaccines. The candidates, sponsors and the timelines are as follows:

By The End Of 2020

- Moderna

- Pfizer Inc. PFE/BioNTech SE – ADR BNTX

- AstraZeneca plc AZN/University of Oxford

- CanSino

First Half Of 2021

- Johnson & Johnson JNJ 0.06%

Second Half Of 2021

Table compiled using Morgan Stanley data.

Judging Initial Coronavirus Efficacy Data

Although conceding that initial clinical data might be difficult to judge, Morgan Stanley said it would look ahead to the proportion of patients that achieve neutralizing antibody levels.

Since these have not been established, the firm said it will compare against animal models as well as antibody titers achieved in cohorts of patients who have recovered from COVID-19.

Morgan Stanley said it believes the NIAID is working on neutralizing titer thresholds that could potentially confer protection, adding that the thresholds could become available prior to the release of initial vaccine data.

Coronavirus Vaccine Market Opportunity

Morgan Stanley believes the pandemic market could be worth $10 billion to $30 billion, with the endemic opportunity at $2 billion to $25 billion.

Related Links:

A Deep Dive On Coronavirus Vaccine Plays Moderna, Inovio

The Week Ahead In Biotech: Aquestive Awaits FDA Decision, Earnings Flow Slows

Latest Ratings for MRNA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| May 2020 | Morgan Stanley | Maintains | Overweight | |

| May 2020 | B of A Securities | Maintains | Neutral | |

| May 2020 | BMO Capital | Maintains | Outperform |

View More Analyst Ratings for MRNA

View the Latest Analyst Ratings

Benzinga's #1 Breakout Stock Every Month

When trading prodigy Gianni Di Poce speaks, smart traders listen. That's because in 2018 Gianni scored a 133% return and he did it again last year with a 64% return.

Gianni's market-beating '3 Delta Factors' thrive in volatile market environments just like today. Best of all, we're just days away from the release of Gianni's next '#1 Breakout Stock Recommendation.

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

No hay comentarios:

Publicar un comentario